When you are closing on a sale to buy real estate, the title company or law firm handling the transfer may ask you how you want to take title to the property. If you are not prepared for this question or do not have a lawyer reviewing the documents, this can be a stressful moment that has long-lasting implications.

Are There Any Encumbrances On The Land?

Before you choose how you want to take title to your new property, you will first want to be sure that the seller has full and exclusive rights to sell the property to you – this is called “clear title.” If there is any lien against the property or any other encumbrance on the land, this is said to “cloud title.”

With clear title, you will be purchasing real estate as you expect it – you will have full ownership of the land and any improvements on the land, such as the house, fence, driveway, and septic system. If the seller cannot prove clear title, then you likely will not want to purchase the property at all.

This is why the closing agent, usually an attorney or title company, will conduct a title search before completing the transfer. The title search is a way to check records and make sure that the title is clear and, therefore, marketable. However, title searches are not foolproof. It is possible that the title search could miss an encumbrance that is not recorded in the land or public records. That is why you obtain title insurance. Title insurance is a policy that covers real estate buyers (up to the coverage amount) in the event that the title search missed something and the seller did not deliver clear title.

Most buyers will not complete a real estate transfer if there is cloud on the title because lenders will not issue a mortgage without title insurance, and a title insurance company will not issue a policy if it finds an encumbrance on the title. If you are paying cash, you may choose to take the property “as is”.

Forms of Property Ownership

Once you are sure that title is clear and marketable, you will then have to decide how to take ownership of the property. How you choose to take title should be reflected in the title documents and, most importantly, on the deed.

Sole Ownership

If you are purchasing real estate with another person, such as a spouse, family member, or business partner, you will have a few options regarding joint ownership. However, if you are purchasing property as a sole owner, titling is much more straightforward. Sole ownership of a property means that the real estate will be owned by one individual. If you are married and choose to own property without the involvement of your spouse, he or she may need to execute an affidavit or quitclaim deed to relinquish any ownership in the property.

Taking title to real estate as the sole owner does not confer any particular tax or estate planning benefits, as there may be in other forms of ownership. There is no creditor protection conferred, as the real estate will just become one of your assets. As a part of your whole estate, real estate will transfer to your heirs through the probate court, unless you transfer ownership to a trust. In Florida, if you transfer your homestead property to a trust, for example, your spouse will need to join in on the conveyance if you are the sole owner on title.

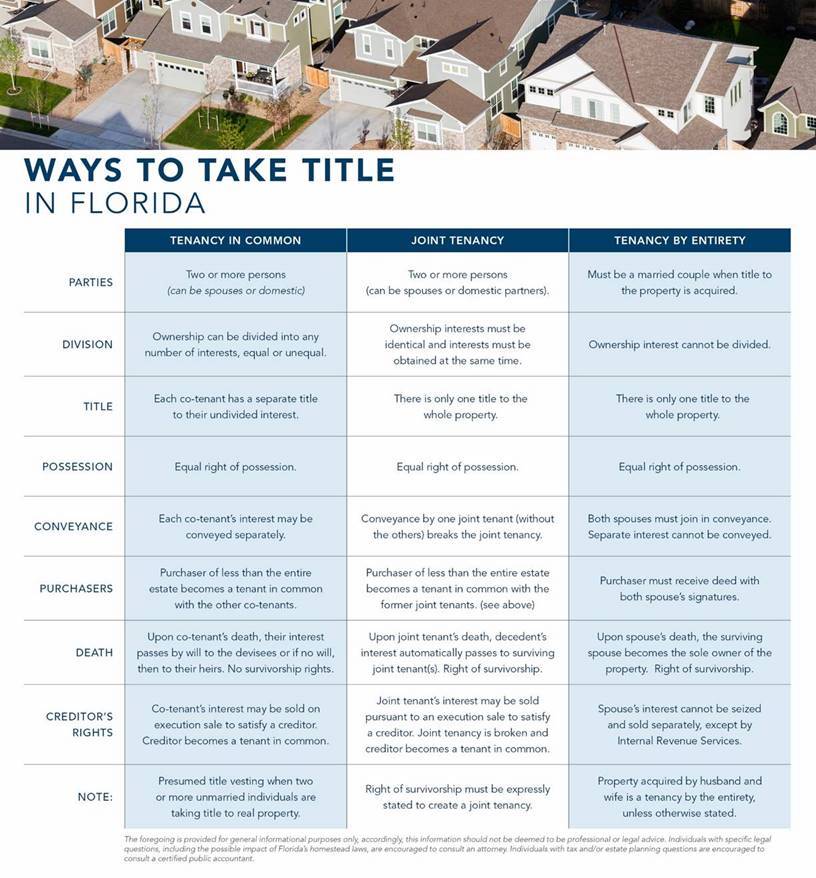

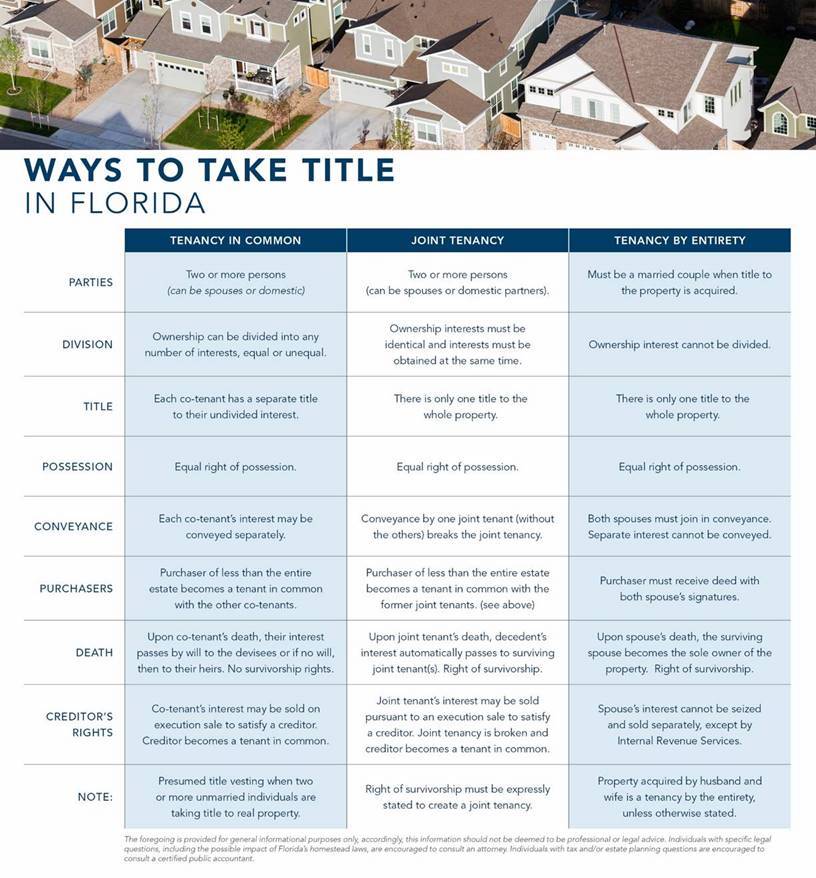

Tenancy in Common

If you and another person(s) want to take ownership of property together and are unmarried, the State of Florida will presume that you are taking title as Tenants in Common. Tenants in Common co-own real estate in shares without the right of survivorship. This means that if one tenant in common dies, his or her share in the property will pass in accordance with his or her will. The surviving tenant in common will then become co-owners with the deceased tenant’s heirs. This is one of the challenges with this form of ownership. Because there is no right of survivorship, it is possible to end up co-owning real estate with someone you do not know.

Tenancy in common does not require that all owners hold equal shares in the property. However, the percentage of ownership held by each tenant in common should be specified in the deed.

Joint Tenancy with a Right of Survivorship

This form of ownership allows more than one person to co-own a property, however, each holds full ownership of a single interest in the property. This means that, if one tenant dies, the other tenant(s) will continue to be sole owner(s) of the property, avoiding the need for probate. In Florida, this form of taking title is most commonly used for family members who wish to keep a property within the family. As joint tenants, all co-owners have equal ownership rights to the property and retain the right to occupy the entire premises.

Florida is a title theory state. This means that, if one joint tenant mortgages his or her interest in the property, the state will consider this a conveyance, and the joint tenancy will be destroyed. By default, the co-ownership will revert to tenants in common. The mortgage will be on a one-half interest in the property, and the other tenant will not be impacted.

Tenancy by the Entirety

Tenancy by the entirety is a special ownership status that is only extended to married persons. Both partners hold an identical interest in the whole property and benefit from the right of survivorship. Tenancy by the entirety is different than joint tenants with a right of survivorship because there is no risk of severance. As long as both partners are alive and still married, neither owner can break the tenancy.

This form of ownership also extends special protection from creditors. In Florida, the entirety estate cannot be breached by creditors of one spouse alone. A creditor would only be able to access a tenancy by the entirety if it is a creditor of both spouses. In the case of divorce, the tenancy by the entirety is terminated, and ownership will revert to tenancy in common.

What If The Owner Is Not A Person?

It is possible to own property in a trust or through a business entity (corporation, LLC, or partnership). Each of these forms of ownership creates additional taxation and estate planning implications. It is best to have an attorney represent your company or trust in the case of a non-person entity taking title to real estate.

Explore All of Your Options

It is always advised to hire a

Florida Real Estate Agent & Florida licensed attorney to help you in the process of taking title to your new real estate purchase.